The Digital Markets, Competition and Consumers Act 2024: Article 2 – the unfair commercial practices

Wednesday 5th February 2025

Overview and scope: misleading acts, omissions and aggressive practices

Introduction

In our first article, we provided an overview of the headline changes in consumer law arising from The Digital Markets, Competition and Consumers Act 2024 (DMCCA). In the subsequent articles we will explore the new legislation in more detail. Here, we will examine the overarching scope of the Act and explore misleading actions and omissions as well as aggressive practices.

Unfair commercial practices – scope

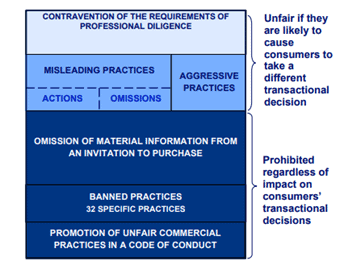

Under the DMCCA, it will be an offence to engage in unfair commercial practices (UCPs) which involve:

- contraventions of the requirements of professional diligence

- misleading actions

- misleading omissions

- aggressive practices

- omission of material information from an invitation to purchase

- specific listed unfair commercial practices listed in Schedule 20 to the DMCC Act.

All offences will be deemed criminal; the trader or individuals can be prosecuted in the criminal courts or subject to the CMA’s direct enforcement regime save for various exceptions. These are:

- failing to comply with a code of conduct (despite stating otherwise);

- using editorial content in the media to promote a product where a trader has paid for the promotion without making that clear in the content or by images or sounds clearly identifiable by the consumer;

- carrying out prohibited practices in relation to fake consumer reviews; and

- including in an advertisement a direct appeal to children to buy advertised products or persuade their parents or other adults to buy advertised products for them.

We anticipate that the vast majority of action will be brought under the new direct enforcement route given the ease and speed by which this can take place compared to prosecution in the criminal courts. Penalties can also be of a similar scale.

Scope of the different UCPs

Misleading actions, omissions, aggressive practices and failure to exercise professional diligence will be regarded as an unfair commercial practice where they are likely to cause a consumer to take a different transactional decision (it is not necessary to prove this where a trader fails to provide material information or engages in a listed banned practice (of which there are 32)).

All of the offences under DMCCA are also strict liability (except for the failure to exercise professional diligence). This means the trader’s state of mind at the time the offence is committed is irrelevant. For a person to be convicted of a contravention of the requirements of professional diligence, it must also be shown that they had a specified state of mind, i.e. knowledge or recklessness in engaging in a commercial practice in a manner that is not professionally diligent.

Breach of most of the prohibitions is subject primarily to the defence of due diligence or innocent publication. Two stages must be satisfied to establish a due diligence defence: the person accused must:

(1) prove that the commission of the offence was due to a mistake or accident, reliance on information given by another person, the act or omission of another, or another cause beyond their control. The accused must then;

(2) prove that they took all reasonable precautions and exercised all due diligence to avoid commission of the offence.

Commercial practices and transactional decisions

Under the DMCCA, a commercial practice includes any act or omission by a trader relating to the promotion or supply of another trader’s product to a consumer. This is very broad and specifically includes:

- the activities of online platforms that facilitate the promotion or supply of products to and from consumers; and

- practices by a trader that enable private individuals (i.e. consumers) to provide products either to that trader (e.g where a trader purchases a used car or an antique from a consumer, or asks the consumer to donate unwanted clothes) or to another person (e.g where an online marketplace is used for consumer-to-consumer transactions).

The definition of a transactional decision is equally broad and is not limited to the purchase of a product or service. It also includes the decision as to whether to visit a shop/website/view a property, sell a product, exercise a consumer right, pay a debt, enter a contract, etc.

Misleading actions

DMCCA prohibits misleading actions which are likely to cause the average consumer to take a different transactional decision.

This prohibition calls out four types of misleading action:

1. Provision of false or misleading information, e.g. selling a premium package for a service which is said to contain certain benefits which are then only available at an additional cost.

2. An overall presentation that is likely to deceive the average consumer. This includes a situation where the information that consumers receive is not actually false, but it is arranged, displayed or otherwise presented in a way that is likely to deceive the average consumer.

Examples would include:

- A trader advertises televisions for sale saying the price has been substantially discounted. However, a footnote explains that only a very small number of the televisions are on sale and only for a very short period of time in one of the trader’s numerous shops.

- A trader uses attention-grabbing pop-up messages on their website to tell consumers of interest in or demand for a product and urging them to act quickly. One message states ‘Be quick! We’ve sold 10 in the last 5 mins.’ Whilst it may be true that the stated number of people have just bought the product, the trader’s stock levels are high.

- A trader highlights just one of several charges for a product on their website and provides less conspicuous information about the other charge(s).

3. Marketing which creates or is likely to create confusion with another trader, or their product or distinguishing mark

Examples would include where:

- A major sunglasses retailer is selling “Sunspex”, a highly successful brand with signature pink colour. A competing trader launches “Sunspeks” in a slightly different shade of pink.

- A trader pays for search results to be shown to consumers who search for a competitor’s product, which lead to a website with a domain name that suggests it is operated by that competitor (while in fact it is not), and as a result consumers purchase products from that website.

4. Failing to comply with a requirement in a code of conduct which a trader purports to be complying with, e.g. where a trader has agreed to be bound by a code of practice that promotes the sustainable use of wood and displays the code’s logo in an advertising campaign and whilst the code of practice contains a clear requirement that its members will not use hardwood from unsustainable sources. , it is found that the product advertised by the trader contains hardwood from endangered rainforests.

Misleading omissions

The DMCCA prohibits practices that may mislead by failing to give consumers the information they need to make an informed transactional decision as a result of which the average consumer is likely to take a different decision. Information is omitted when it is not included.

However, information may also be considered omitted where it is provided to a consumer, but it is provided in a way that is unclear or untimely, or when the consumer is unlikely to see it.

A misleading omission takes places where a trader:

- omits material information or information which the trader is required under any other piece of legislation to give to a consumer as part of the practice; or

- fails to identify their commercial intent unless it is already apparent from the context.

Examples would include the following:

- a car park trader fails to display the price(s) of parking clearly at a point before the consumer enters the car park and incurs a charge.

- a trader lists a biomass boiler for sale on a webpage on their website. The webpage contains an image and a brief description of the boiler, alongside a claim ‘cut your bills by £1,700 each year with a pellet boiler’. A separate hyperlink is given to find out important qualifying information, including that the running costs would depend on the size of the property the boiler is installed in.

- a trader omits to mention (at all or until the final checkout) that a contract has to run for a minimum period, or that the consumer must make purchases in future.

- a trader makes a claim that a product is ‘greener’. The claim does not make clear the basis for the comparison. It is unclear whether the product is ‘greener’ than other products the trader sells, or those sold by a competitor, or what is meant by the term ‘greener’.

- a trader contacts consumers by telephone and asks them to take part in a survey about their views on personal security in the area. However, during the call the trader asks consumers if they want to purchase a burglar alarm system.

Aggressive practices

DMCCA also prohibits commercial practices which involve harassment, coercion or undue influence such that the average consumer is likely to take a different transactional decision.

Harassment, coercion or undue influence are techniques that intimidate, exploit or otherwise pressure consumers and particular consideration is given to the nature of the practice, the timing and location, any potential vulnerability, and whether practice requires a consumer to take disproportionately onerous steps.

Many of the examples will be very obvious, but more subtle ones include where:

- an online retailer uses a contract termination process that requires customers to click multiple times to confirm their decision to terminate and enter additional details about their reasons for termination.

- a car retailer ignores customer complaint communications for several weeks and eventually informs the consumer they will need to book the car in for a check by phoning a special number (which is then also ignored).

Every B2C business will be well-advised to review and understand their customer journeys including on key topics such as how and what information is presented to customers to avoid falling foul of undertaking misleading actions or omissions.

The next and third article in our mini-series about the consumer protection provisions of the DMCCA will focus on professional diligence, invitations to purchase and banned practices (including fake reviews)

If you have any questions about how the DMCCA applies to you, please contact a member of our Regulatory Team today.